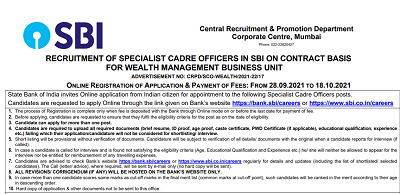

SBI Specialist Cadre Officers 2021 :- State Bank of India invites application through Online mode for Indian citizen for appointment to the following Specialist Cadre Officers posts. interested and eligible Candidates are apply Online through the SBI website.

Table of Contents

SBI Specialist Cadre Officers 2021 :- Important Date :-

ONLINEREGISTRATION OF APPLICATION & PAYMENT OF FEES: FROM 28.09.2021 TO 18.10.2021

SBI Specialist Cadre Officers 2021 :- Application Fees

- General/EWS/OBC candidates :- 750/- Rs.

- SC/ ST/ PWD candidates :- No Fees.

SBI Specialist Cadre Officers 2021 :- Vacancy Detail , Age And CTC

| Sr. No. | Name of Post @ | Total Vacancy | Age as on 01.08.2021 min | Age as on 01.08.2021 max | CTC Range |

| 1. | Relationship Manager | 314 | 23 | 35 | Rs. 6-15 lakhs |

| 2. | Relationship Manager (Team Lead) | 20 | 28 | 40 | Rs. 10-28 lakhs |

| 3. | Customer Relationship Executive | 217 | 20 | 35 | Rs. 2-3 lakhs |

| 4. | Investment Officer | 12 | 28 | 40 | Rs. 12-18 lakhs |

| 5. | Central Research Team (Product Lead) | 2 | 30 | 45 | Rs. 25-45 lakhs |

| 6. | Central research Team (Support) | 2 | 25 | 35 | Rs. 7-10 lakhs |

SSC Phase 9 Recruitment 2021 Notification-Bumper Post -3216

SBI Specialist Cadre Officers 2021 :- Education Qualification

| SR.NO. | NAME OF POST | EDUCATIONAL QUALIFICATION | POST–QUALIFICATION EXPERIENCE (AS ON 01.08.2021) |

| 1 | Relationship Manager | Graduates from Government recognised University or Institution | Post-qualification experience of minimum 3 Years as a Relationship Manager in Wealth Management with leading Public/Private/Foreign Banks/Broking/ Security firms. The candidate should have adequate experience in building and managing relationship with High-Net-worth Clients (having a minimum Total Relationship Value (TRV) of Rs 20.00 Lakh). |

| 2 | Relationship Manager (Team Lead) | Graduates from Government recognised University or Institution | Post qualification experience of minimum 8 years in relationship management in wealth management with leading Public/Private/Foreign banks/Broking/ Security firms.Experience as a Team Lead is preferred. |

| 3 | Customer Relationship Executive | Graduates from Government recognised University or Institution | 1.Experience in documentation requirements of financial products and good communications skills would be desirable. Specific Skills Required: 1.SHOULD HAVE A VALID DRIVING LICENCE FOR TWO-WHEELER (Mandatory) |

| 4 | Investment Officer | Graduates / Post Graduates from Government recognised University or Institution. Mandatory: Certification by NISM/CWM Preferred: CA/CFP (As on 01/08/2021) | Minimum 5 years of post-qualification experience as an investment advisor/counsellor/part of product team in Wealth Management organisation. Preferred Experience: Good knowledge of investments and markets across asset classes.Experience in managing and guiding client portfolios.Good knowledge of asset allocation and re-balancing techniques.Superior presentation skills & other core competencies like leadership and team work.Experience in products of fixed income, equity & alternate markets. |

| 5 | Central Research Team (Product Lead) | MBA/PGDM from recognised College/University or CA/CFA Preferred: NISM Investment Advisor / Research Analyst Certificate/CFP( As on 01/08/2021) | Minimum 5 years post qualification experience in Equity Research/Products experience in Wealth Management / AMC (Mutual Funds) / Banks. Preferred Experience: Minimum 8 years’ experience in Equity/Fixed Income Research/MF Research AnalyticsExcellent Knowledge on local and global economic trendsExcellent Knowledge on local Primary/Secondary Equity Markets/Fixed Income and on PMS/AIF/MF/ Structured Products schemes in India.Experience in creating views and research-based publication on capital Market / sector trends.Proficiency in using Excel / Modeling techniques / Bloomberg / Reuters /Morning Star / CRISIL data bases. Flair for equity, understanding of all exchange traded products including bonds, INVIT, MLDs, REITs, Section 54 EC Bonds. |

| 6 | Central research Team (Support) | Graduate/Post Graduate in – Commerce/Finance/Economics/Management/Mathematics/ Statistics from Government recognized University or Institution. | Candidate should have post qualification experience of minimum 3 years work experience in financial services providing support to Research / Publications departments. Preferred Skills: Candidate should be proficient in Microsoft Excel, Power point, Word, Outlook.Candidate should have inclination to undertake research by reading various reports or websites.Candidate should be able to support Research team by aggregating and providing support for analysing data through various research tools / software like BLOOMBERG, REUTERS, CRISIL, ICRA etc |

Allahabad University Non Teaching Recruitment 2021

SBI Specialist Cadre Officers 2021 :- Job and Responsibility

| SR.NO. | NAME OF POST | JOB PROFILE | KEY RESPONSIBILITY AREAS |

| 1 | Relationship Manager | Acquiring, nurturing growing and strengthening relationship within the Affluent and HNI segment of Clients in order to meet business objectivesSelling a range of Investment and Insurance products to these Clients in order to meet their financial needs objectives and thus attaining the revenue objectives of the Wealth Management business Focusing on increasing the Total Relationship Value (TRV) and Assets Under Management (AUM) of Clients as per the business objectives | Acquire HNI and Affluent ClientsDeepen RelationshipsManage the Clients of the branch who are defined as Affluent/HNI ClientsGrow the CASA of this portfolioSelling mortgages, credit cards and drive channel migrationAcquire more Clients from the same householdService these Clients.Wealth ManagementDo a Financial Need Analysis of Client Portfolio and Risk Profiling for the ClientsPeriodic Portfolio reviews for all ClientsSelling investments, life insurance, general insurance and SIP.Ensure all Clients have a CASA for routing their investments.ComplianceEnsure AMFI, IRDA and NISM certificationEnsure all Clients instructions are executed the same dayEnsure 100% documentation of all transactions.Branch DevelopmentConduct branch Insurance & Investment seminars to spread financial awareness.Any other matter, as may be entrusted by the Bank from time to time |

| 2 | Relationship Manager (Team Lead) | Managing a team of Relationship Mangers for the Wealth Management BusinessAcquiring, nurturing growing and strengthening relationship within the Affluent and HNI segment of Clients in order to meet business objectivesSelling a range of Investment and Insurance products to these Clients in order to meet their financial needs objectives and thus attaining the revenue objectives of the Wealth Management businessFocusing on increasing the Total Relationship Value (TRV) and Assets Under Management (AUM) of Clients as per the business objectives | Acquire HNI and Affluent ClientsManaging the team of Relationship Mangers and ensuring the team achieves its targetsEnsuring compliance of guidelines, systems & procedures by the Relationship Manager teamAllocation of leads and Clients to appropriate team membersDeepen RelationshipsManage the Clients of the Bank who are defined as Affluent/HNI ClientsGrow the CASA of this portfolioSelling mortgages, credit cards and drive channel migrationAcquire more Clients from the same householdService these Clients. Wealth ManagementDo a Financial Need Analysis of Client Portfolio and Risk Profiling for the Clients. Periodic Portfolio reviews for all ClientsSelling investments, life insurance, general insurance and SIP.Ensure all Clients have a CASA for routing their investments.ComplianceEnsure all Clients instructions are executed the same dayEnsure 100% documentation of all transactions.Branch DevelopmentConduct branch Insurance & Investment seminars to spread financial awareness.Any other matter, as may be entrusted by the Bank from time to time |

| 3 | Customer Relationship Executive | CREs are responsible for providing on ground support to Relationship Managers in collecting the documents from the Clients and sending it to the relevant department for service requests where documentation or in person meeting with Client is required. | Assisting Relationship Managers in collecting and delivery of documents from/to wealth Clients.Assisting Service Managers in completion of onboarding documentation.Assisting Relationship Managers/Service Managers in collection and delivery of documents in different departments of the Bank.Doorstep Banking to Clients.Any other matters may be entrusted by the Bank from time to time. |

| 4 | Investment Officer | Guiding clients on range of financial services productsWide ranging experience across categories such as: MF, FI, Structured Products, Discretionary PortfoliosStrong focus on due diligence, quantitative technique and asset allocation. | Assisting the Relationship Manager in providing expert opinion regarding investments.a) Work closely with RMs for guiding their Clients Investment needs.Research and investigate new investment opportunities to determine relevance for clientsGuiding the Clients on the right investment products based on their needs and Improving Client’s understanding of complex and structured products. Answer clients’ questions about the purposes and details of financial plans and strategies referred to by RMs.Research / create house view on investment products and market.Coaching and regularly updating the RM team on latest developments and investment productsWealth ManagementDo a Financial Need Analysis of Client Portfolio and Risk Profiling for the Clients.Periodic Portfolio reviews for all ClientsComplianceEnsure AMFI, IRDA and NISM certificationAny other matter, as may be entrusted by the Bank from time to time |

| 5 | Central Research Team (Product Lead) | The Official would work closely with Product, Investment & Research Head and would be responsible for running products program of wealth products and liaison with Market data Aggregators and Research providers. The Official will be responsible to write product notes, market updates, investment outlook and evaluate latest product offering in addition handling all queries related to products. | The Official would work closely with Product & Research Head and conduct the following activities : Understand the current broader wealth products trends.Create forward looking view on equity market and specific sectors.Create regular updates on happening of equity marketAnalyse various PMS/AIF/MF/Structured Products scheme offerings and conduct due diligence for approvalLiaison with other departments & outside agencies for equity Markets.Analytics of Equity PMS/AIF/Other wealth product and Client portfolios.Liaison with Market data aggregators and research report providersRegular interaction with Investment and RM teams.Any other matter as may be entrusted by the Bank from time to time. |

| 6 | Central research Team (Support) | Role will include creating and updating excel worksheets related to Macro Economy, Stock & Sector research, Fixed Income research, creating portfolio review templates etc | Creating and updating excel worksheets related to :Macro EconomyStock & Sector researchFixed Income researchMutual Fund, PMS & other products researchModel portfoliosCreating portfolio review templates which are used in order to support Investment Officers and Relationship Managerspreparing portfolio review templates and to support Investment Officers and Relationship ManagersTo work closely with the research team in terms of designing as well as rolling out daily, weekly, monthly publications / presentations on regular basis. |

SBI Specialist Cadre Officers 2021 GUIDELINES FOR FILLING ONLINE APPLICATION:

- Candidates will be required to register themselves online through the link available on SBI website https://bank.sbi/careers OR https://www.sbi.co.in/careers and pay the application fee using Internet Banking/ Debit Card/ Credit Card etc.

- Candidates should first scan their latest photograph and signature. Online application will not be registered unless candidate uploads his/ her photo and signature as specified on the online registration page (under ‘How to Upload Document”).

- Candidates should fill the application carefully. Once application is filled-in completely, candidate should submit the same. In the event of candidate not being able to fill the application in one go, he can save the information already entered. When the information/ application is saved, a provisional registration number and password is generated by the system and displayed on the screen. Candidate should note down the registration number and password. They can re-open the saved application using registration number and password and edit the particulars, if needed. This facility of editing the saved information will be available for three times only. Once the application is filled completely, candidate should submit the same and proceed for online payment of fee.

After registering online, the candidates are advised to take a printout of the system generated online application forms

| SBI Specialist Cadre Officers 2021 :- Notification |

| SBI Specialist Cadre Officers 2021 :- website Link |